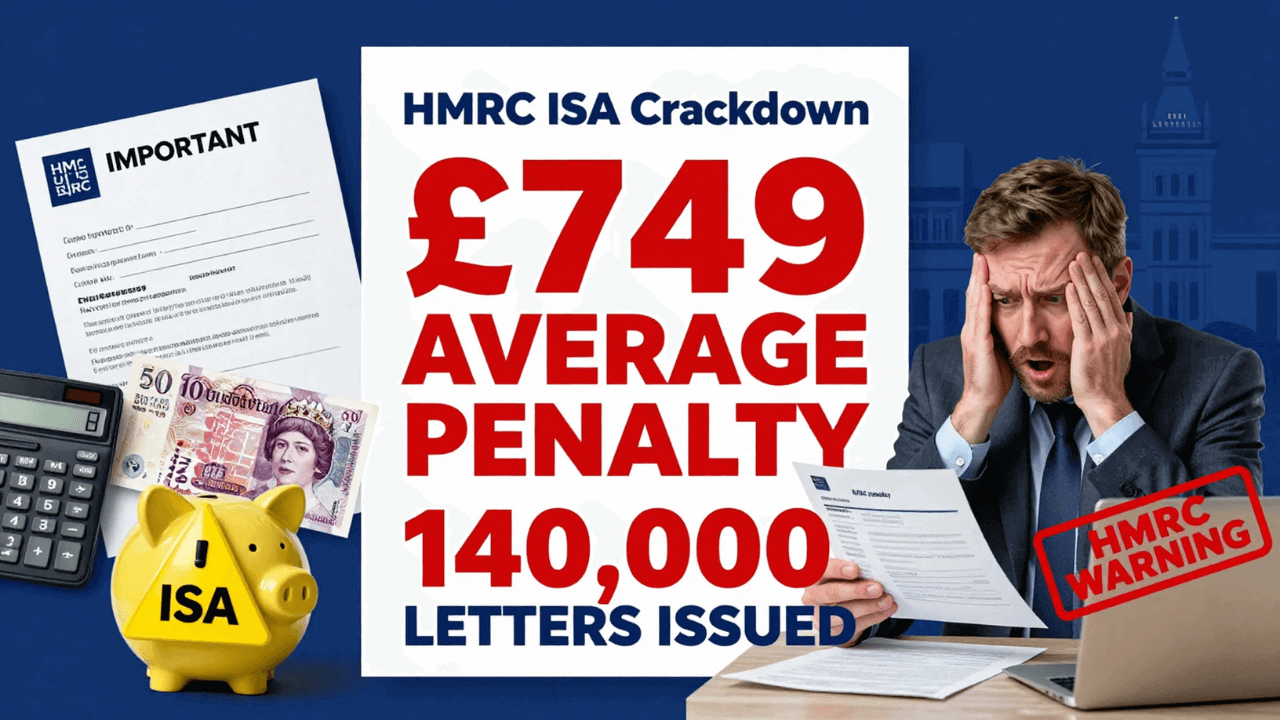

For years, Individual Savings Accounts (ISAs) have been promoted as one of the safest and most tax‑efficient ways for people in the UK to save money. Millions of savers use ISAs believing their money is fully protected from tax problems. That is why recent headlines claiming an HMRC crackdown on ISA savers, involving 140,000 letters and an average £749 penalty, have caused confusion and concern.

Many people are now asking difficult questions. Can HMRC really fine ISA savers? Are ISAs no longer tax‑free? What mistakes are triggering these letters? And could ordinary savers be affected without realising it?

The truth is more nuanced than the headline suggests. This is not a tax grab on normal ISA savings, and it does not mean ISAs have lost their tax‑free status. Instead, the crackdown is focused on rule breaches, reporting errors, and excess contributions — often made unintentionally.

This article explains what is really happening, why HMRC is sending these letters, who is most at risk, and what ISA savers should do to stay safe.

Understanding ISAs and why they are normally tax‑free

An ISA is a government‑approved savings and investment account that allows individuals to earn interest, dividends, or investment gains without paying tax.

The key attraction of ISAs is simple:

- interest earned is tax‑free

- capital gains are tax‑free

- no need to declare ISA income on a tax return

However, this tax‑free status applies only if the ISA rules are followed correctly.

The role of HMRC in ISA oversight

Although ISAs are tax‑efficient, they are still regulated by HM Revenue and Customs. Banks, building societies, and investment platforms report ISA activity to HMRC each year.

HMRC does not routinely interfere with compliant ISA accounts. Action is usually taken only when data shows that:

- ISA rules may have been broken

- allowances may have been exceeded

- incorrect accounts have been opened

- reporting discrepancies exist

The recent increase in letters reflects improved data‑matching systems rather than a sudden policy change.

What the 140,000 HMRC letters are really about

The figure of 140,000 letters refers to formal HMRC communications sent to savers whose ISA records raised concerns.

These letters typically relate to:

- exceeding the annual ISA allowance

- opening more than one ISA of the same type in a tax year

- contributing to an ISA after becoming non‑UK resident

- administrative errors made by providers but linked to the saver

In many cases, the saver did not deliberately break the rules.

Why the average penalty is £749

The reported £749 average penalty does not mean every recipient paid exactly that amount.

The figure usually reflects a combination of:

- tax owed on invalid ISA income

- interest charged by HMRC

- penalties for incorrect reporting

Some people pay less, some pay more, and some successfully challenge the amount.

Common ISA mistakes that trigger HMRC action

Many ISA breaches happen accidentally. These are the most common causes.

Exceeding the annual ISA allowance

Each tax year, there is a maximum amount you can put into ISAs. Contributing more than the allowed limit — even by mistake — invalidates the excess amount.

This often happens when:

- people use multiple providers

- transfers are misunderstood

- old accounts are forgotten

Opening multiple ISAs of the same type

You can only subscribe to one Cash ISA and one Stocks and Shares ISA per tax year.

Some savers accidentally open two Cash ISAs, especially when switching banks or chasing better rates.

Continuing ISA contributions after leaving the UK

Once you are no longer a UK tax resident, you generally cannot add new money to an ISA, even though you can keep existing funds invested.

Many people moving abroad are unaware of this rule.

Incorrect transfers between providers

Transfers must be completed using official ISA transfer processes. Withdrawing money and redepositing it incorrectly can break ISA protection.

Why HMRC action has increased recently

This is not a sudden attack on savers. Several factors explain the rise.

Better data‑sharing

ISA providers now report more detailed information digitally, making it easier for HMRC to spot inconsistencies.

Higher interest rates

With interest rates higher, ISA income is larger, making breaches more visible and more costly.

Increased compliance checks

HMRC has increased automated checks across all savings products, not just ISAs.

Are ISAs still tax‑free

Yes.

ISAs remain fully tax‑free when used correctly.

HMRC is not taxing ISA interest across the board. It is correcting situations where accounts lost their tax‑free status due to rule breaches.

What HMRC letters usually say

Most letters are formal but not aggressive. They usually include:

- an explanation of the issue

- details of the affected tax year

- how HMRC calculated the amount owed

- instructions on how to respond or appeal

Importantly, receiving a letter does not automatically mean guilt. It means HMRC wants clarification or correction.

Can you challenge an HMRC ISA penalty

Yes.

If you believe the letter is wrong, you can:

- request a review

- provide evidence from your provider

- challenge calculations

- appeal penalties

Many penalties are reduced or cancelled after clarification.

What ISA savers should do if they receive a letter

The most important thing is not to panic.

Read the letter carefully

Do not ignore it, but do not assume the worst.

Check your records

Look at past contributions, transfers, and providers.

Contact your ISA provider

They can confirm whether an error occurred and provide statements.

Respond on time

Missing deadlines can increase penalties.

Seek advice if needed

Independent tax advice can help in complex cases.

Who is most at risk of receiving a letter

While anyone can be affected, higher‑risk groups include:

- people using multiple ISA providers

- frequent account switchers

- those close to the annual allowance limit

- people who moved abroad

- savers with long‑running legacy accounts

Simple savers with one provider and modest contributions are less likely to be affected.

What this crackdown does NOT mean

It does not mean:

- ISAs are being abolished

- HMRC is taxing all ISA savings

- ordinary savers will automatically be fined

- new ISA taxes are being introduced

The action is targeted, not universal.

How to stay safe as an ISA saver

A few simple habits can prevent problems.

- track total annual contributions

- use official transfer processes

- avoid opening multiple ISAs of the same type

- inform providers if you move abroad

- keep annual statements

These steps dramatically reduce risk.

Scams exploiting ISA fear

Whenever HMRC enforcement makes headlines, scams follow.

Be cautious of messages claiming:

- “HMRC fine due on your ISA”

- “Pay now to avoid prosecution”

- “Confirm ISA details urgently”

HMRC does not demand payment by text or email.

Why this matters for confidence in savings

ISAs are a cornerstone of personal savings in the UK. Clear rules and fair enforcement help protect the system’s integrity.

Most savers who follow the rules will never hear from HMRC at all.

Key points to remember

- 140,000 letters target specific rule breaches

- £749 is an average, not a fixed fine

- ISAs remain tax‑free when rules are followed

- Most breaches are accidental

- HMRC letters can be challenged

- Good record‑keeping prevents problems

Final thoughts

The headline “HMRC Crackdown on ISA Savers” sounds alarming, but the reality is far more measured. This is not an attack on saving, nor a sign that ISAs are no longer safe. It is a compliance exercise aimed at correcting errors where tax‑free rules were unintentionally broken.

For the vast majority of UK savers who stay within limits and follow transfer rules, ISAs remain one of the most reliable and tax‑efficient ways to build financial security.

Understanding the rules — and responding calmly if contacted — is the best protection any saver can have.